Progressive interest

Recently, I face a problem. My Client bought a new launch property which is new project in penang. So, she paid the booking to reserve the unit that she love. She applied loan and proceeded to sign SPA (Sales and Purchase Agreement). Waiting to get her new house happily.

Few months after she signed the S&P, bank asking her to pay the interest monthly. She is frustrated due to the agent told her that only need to pay the monthly installment after she get the key of her dream house.

I only realised, many people will forget about the progressive interest.

So,

- What is progressive interest?

- When to Pay?

- How much to pay?

1. What is Progressive interest

Progressive interest refers to an interest structure where the interest rate or payment amount increases over time, often associated with certain types of loans or financing arrangements. This method is commonly seen in property financing, where the borrower’s repayment obligations grow as the loan term progresses.

In real estate, progressive interest might apply to development projects, where initial payments are lower while the project is being constructed and increase once the property is completed or occupied. This approach allows borrowers to manage cash flow during the early stages but requires careful planning to accommodate the rising costs in later stages.

2. When to pay the progressive interest

Developers typically collect progressive interest at specific milestones during the construction of a property. The payment schedule is usually outlined in the sale and purchase agreement and may include the following phases:

Booking Fee: A small deposit is paid upon signing the agreement.

- Downpayment : 10% ( subject to projects)

Construction Milestones: Payments are made at various stages of construction, such as:

- Completion of the foundation

- Completion of the superstructure

- Installation of the roof

- Completion of the unit’s interior

- Final inspection or handover of the keys

Occupancy or Handover: The final payment is often due upon handover of the property, when the buyer officially takes possession.

This structure allows the developer to fund the construction as it progresses while giving the buyer a clearer understanding of when payments are due based on the project’s development stages.

Note !!!

* Subject to developers and project. Can ask your property consultant for the schedule.

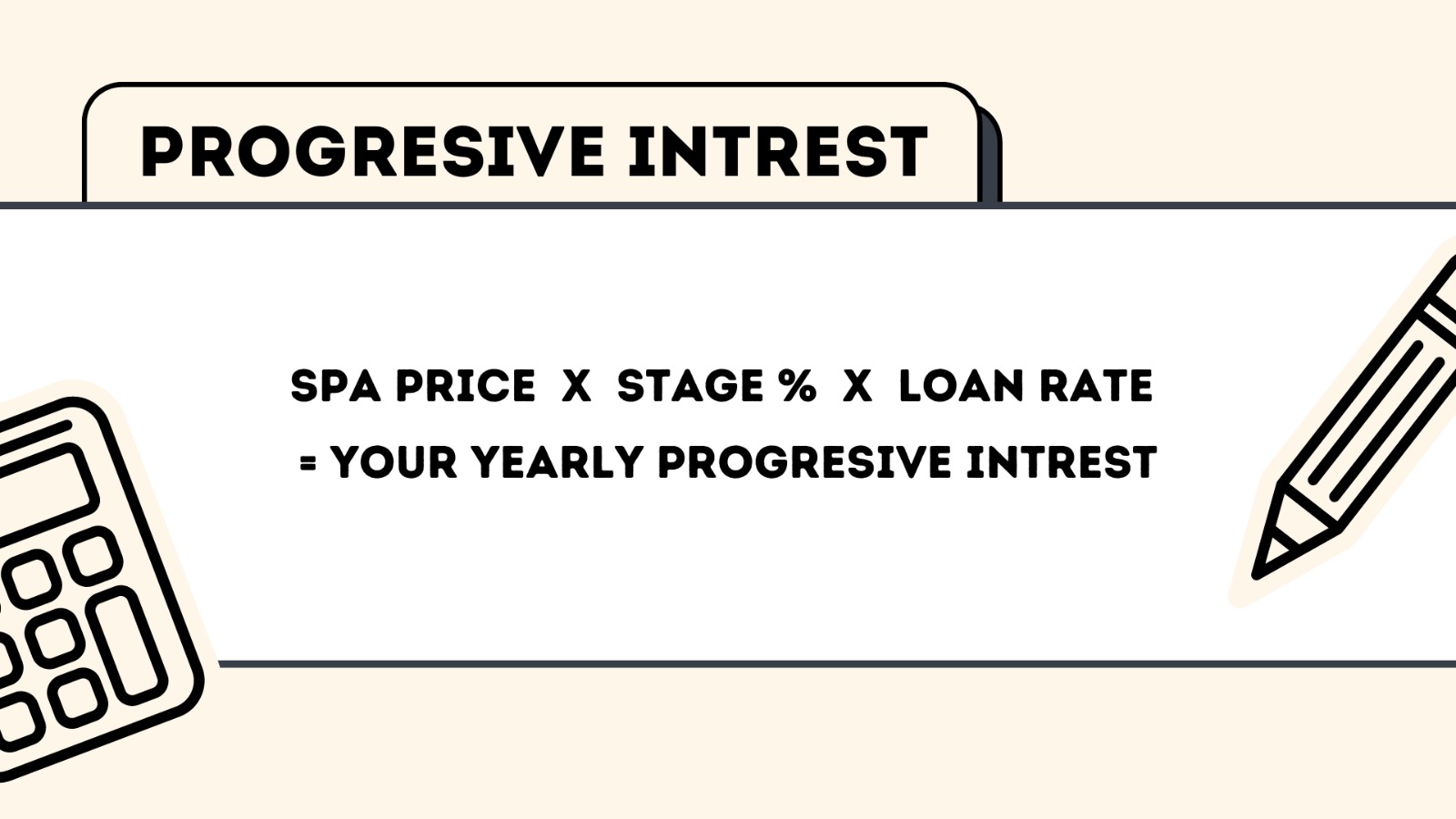

3. calculate the fees

for example

You buying a new project. The project price is RM 1,000,000. and you are taking loan from xxx bank. The loan interest rate is 4%. The property is in the stage of completion of the foundation (normally we will call it as Stage 2A). So, they will collect the fund of construction, it might be a 10%.

- SPA PRICE : RM 1,000,000

- Stage % : 10%

- Loan interest rate : 4%

With the formula above : SPA price x Stage % x Loan rate = Your Yearly progressive interest

RM 1,000,000 x 10% x 4% = RM 4,000

RM 4,000 / 12 = RM 333.33 ( Monthly interest)

RM4,000 / 365 = RM 10.96 ( Daily interest)

Note !!!

The total amount of construction interest cannot be calculated because construction interest is cumulative.

*Construction progress is slow: more construction interest is paid than grain

*Construction progress is fast: less construction interest is paid.

Summary

Progressive interest refers to the interest charged on a home loan as the property is being built. It is calculated based on the portion of the loan disbursed to the developer at various stages of construction. The developer collects payments at key milestones, such as completion of the foundation, superstructure, roofing, interior, and final handover. Buyers pay interest only on the amount disbursed, which increases as construction progresses.

So, the stage, the date paying, subject to the developer. Please refer to the property consultant.

Happy buying.

More Project

The Crown

More InfosMoulmein Rise

More infoLumina Residence

More infoJesselton Courtyard

More infoMore New Project

More info

Previous slide

Next slide

More Property Infos

OPR Reduced to 2.75%: How It Affects Loans, Savings & Spending

What is the fees that need to pay while rent a property in

What is mortgage loan should we know?

Know more about the SPA, Stamp Duty Malaysia, and Legal Fees for Property Purchase in 2024

What is The progressive interest? How much they collect the interest?